Montana Aerospace AG (the ‘Company’) and its operating subsidiaries (the ‘Group’ or ‘Montana Aerospace’), a leading, highly-vertically integrated manufacturer and supplier of system components and complex assemblies for the aerospace, e-mobility and energy industries with worldwide engineering and manufacturing operations, publishes its 9M 2022 results today, emphasizing the Group’s unique business model, capabilities, and capacity which will drive future market share gains.

HIGHLIGHTS 9M 2022

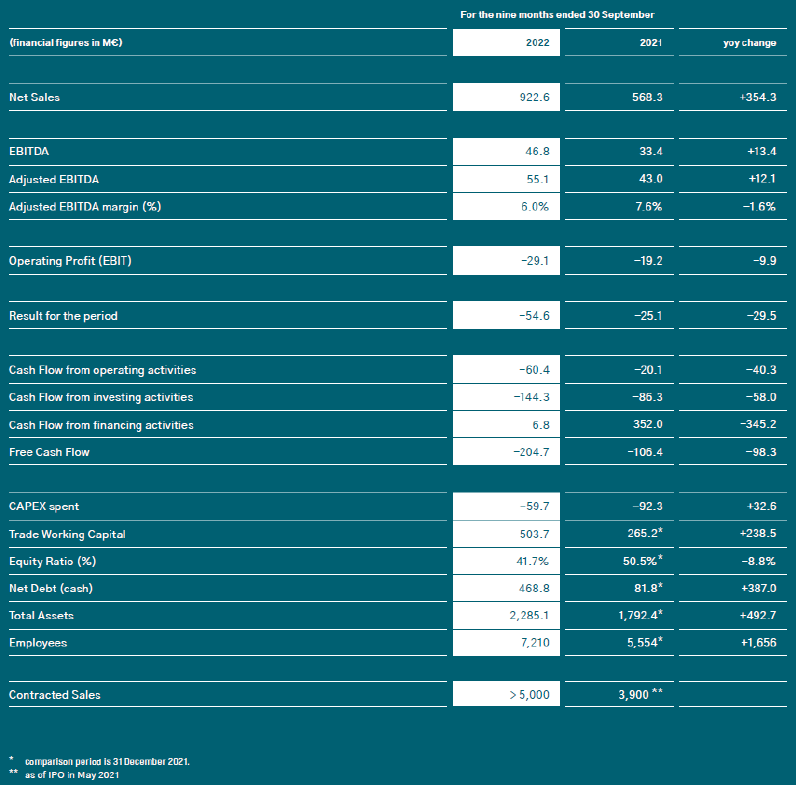

▪ Financials: Net Sales grew by 62.3% YoY to EUR 922.6 million; adj. EBITDA performance in line with guidance, reaching EUR 55.1 million (+28.3% YoY), benefitting from high resilience to current headwinds, based on vertical integration and strategic inventory as well as anticyclical investment program and high order intake and backlog

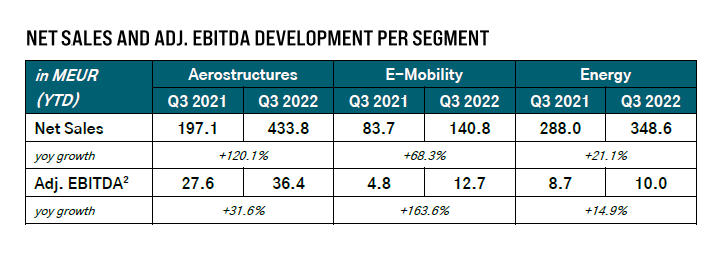

▪ Segment Net Sales: ‘Aerostructures’ (+120.1%), ‘E-Mobility’ (+68.3%) and ‘Energy’ (+21.1%)

▪ Segment adj. EBITDA: ‘Aerostructures’ (+31.6%), ‘E-Mobility’ (+163.6%) and ‘Energy’ (+14.9%)

▪ Guidance confirmed again: with around EUR ~1.16 billion of Net Sales in 2022 (thereof ~85% organic- and ~15% inorganic growth) and an adj. EBITDA of a high double-digit EUR million amount, our guidance for 2022 is confirmed once again; clear focus on FCF generation + deleveraging from 2023 onwards

▪ Energy Costs: energy costs rose again in the 3rd quarter but seem to show less volatility at a high level since then (about 3-4x as much as in the previous year); estimated FY 2022 energy costs (gas + electricity) of over EUR 70 million (vs. EUR 17 million in FY 2021) with the ability to pass through roughly two thirds (with a time lag)

▪ Inventory / Trade Working Capital: working capital has been over proportional but strategically intended high and peaked with EUR 504 million in Q3; increase of working capital from Q2 to Q3 mostly triggered by acquisition of Sao Marco (transaction was priced on a percentage of the taken over working capital); clear commitment that working capital should normalise to more sustainable levels over the coming quarters and already in Q4 as most programs are ramped up; high levels of inventory and herewith of raw material together with the long value chain of Montana Aerospace helped to materialize and increase over proportional Net Sales while many competitors and industries struggle to keep up with the ramp up

▪ Free Cash Flow / Net Income: FCF generation has been negative in the past years, as we have invested into new capacities massively; working capital reduction in combination with higher benefits from operating leverage as well as finishing the current CAPEX programme should sustainably drive FCF generation over the next quarters; clear commitment to be FCF & Net Income positive from 2023 onwards and further strengthen the balance sheet through debt reduction by own means

▪ Balance Sheet / Covenants: consciously stressed balance sheet in FY 2022 (mainly due to ASCO & Sao Marco transaction as well as working capital financing) with a peak per Q3 2022; clear target of swiftly deleveraging already this year to a more sustainable level through monetizing on working capital as well as the consumption or sale of excess raw material stock and more efforts on cash collection; forward looking (mid-term) Net Debt / EBITDA level should be at a maximum of 2,5x; no covenants on Montana Aerospace AG level in place; majority of Promissory Notes (major part of debt position) based on fixed interest rate; additionally, no further cap raise planned

▪ Contracted Sales: ramp-up of our operational performance and proof-of-concept of ability to execute large work packages; particularly acquisition of ASCO Industries pushed our positioning in the highly demanded A320 aircraft (family); total contracted sales volume reached more than EUR 5bn as of end of September 2022, reflecting a growth of more than 30% compared to the EUR 3.9bn from the time of the IPO (May 2021); total volume based on reduced/risk-adjusted build rate estimates; unique vertical integration and ‘one-stop-shop’ concept in combination with local-to-local production (best-cost-countries), push market share gains in the coming years

▪ Build Rates: continued growth in demand from airline operators for narrowbody aircrafts as a result of passengers‘ accelerated return to traveling; forward-looking guidance still based on lower/risk adjusted build rate expectation than OEM´s planned announcements to take risen level of global supply chain uncertainty and other facts into account (e.g. Montana Aerospace estimate of low 60s for the A320 family in 2025); full flexibility if demand rises faster without any (significant) CAPEX investment

▪ Raw Materials: raw material availability risk relatively minor for Montana Aerospace due to high recycling capability / vertical integration in aluminium (100% of internal scrap is recycled; 70% of all aluminium used is recycled material) as well as strong inventory and secured supply for titanium demand; for major materials 100% pass-through mechanisms of any price increases in place

▪ Labor: wage cost inflation in line with budgeted inflation rates of 10-12% on overall Group perspective, keeping in mind that 90% of European workers work in best-cost-country environments; personnel costs under proportional to Net Sales CAGR; for 2022, no shortfall of people foreseeable; for future ramp-up – especially in Romania (after finishing CAPEX projects this year) – the Group is planning to hire an additional 500 people over the next years; strong collaborations and attractive conditions within its global approach shall secure talent sourcing in competitive environment

▪ M&A: successful closing of the acquisition of 100% of the shares of S.R.I.F. NV in Belgium (‘Asco’) on 31st March 2022; roughly EUR 150 million of Net Sales contribution for FY 2022 (9 months contribution) and no EBITDA contribution due to post-merger integration costs; sticking to long-term guidance of EUR 300m of Net Sales with an EBITDA margin potential of 15% (+ additional 5% of synergy potential through removal of external suppliers of prefabricated products and internalisation of work); high expertise in automatization capabilities as well as strong exposure to A320 including a strong sales pipeline for the narrowbody with an engineering development / design office that has recognized competences in Wing movables engineering and is already active on the project ‘Wing of Tomorrow’ together with Airbus; successful closing in September 2022 of the acquisition of 100% of the shares of Sao Marco in Brazil; purchase price based on a percentage of the Trade Working Capital taken over; further strengthening our capabilities in recycling and so-called ‘green copper’

▪ CAPEX: finishing steps of ramp-up of major CAPEX programme of the last years (> EUR 600 million of investments since 2018 especially in our two large greenfield sites in Romania and Vietnam); from 2023 onwards, only sustainable CAPEX in the amount of slightly above half of yearly D&A, as installed capacity allows to further grow materially without large new investments

▪ Transportation Costs:

comparatively less affected by increasing transportation costs as Montana Aerospace only relies on certain inbound logistics due to our vertical integration and one-stop-shop approach; extra costs of low single-digit EUR million amount for FY 2022, already reflected in full year guidance

OPERATIONALLY ON TRACK IN 9M 2022

Net Sales

In the first nine months of 2022, Montana Aerospace generated consolidated Net Sales of EUR 922.6 million, which is 62.3% above the previous year’s EUR 568.2 million, by far surpassing any pre-Covid levels. The greatest contribution to Net Sales is by the business segment ‘Aerostructures’, which also shows the strongest Q3 recovery versus 2021, closely followed by ‘E-Mobility’. In general, the positive development was supported by Montana Aerospace’s acquisitions of ASCO and Sao Marco, contributing slightly more than EUR 120 million to Net Sales in the first nine months in 2022.

In the first nine months of 2022, Montana Aerospace generated consolidated Net Sales of EUR 922.6 million, which is 62.3% above the previous year’s EUR 568.2 million, by far surpassing any pre-Covid levels. The greatest contribution to Net Sales is by the business segment ‘Aerostructures’, which also shows the strongest Q3 recovery versus 2021, closely followed by ‘E-Mobility’. In general, the positive development was supported by Montana Aerospace’s acquisitions of ASCO and Sao Marco, contributing slightly more than EUR 120 million to Net Sales in the first nine months in 2022.

EBITDA

Accounting for one-off and non-operative effects – most notably the management stock option program (MSOP) – the adjusted EBITDA1 reached EUR 55.1 million in the first nine months in 2022, exceeding the level of EUR 43.0 million in the same period in 2021. This translates into an adjusted EBITDA margin of 6.0% as compared to Q2’s 5.9% and the previous year’s Q3 level of 7.3%. On a non-adjusted level, reported Group EBITDA increased from EUR 33.4 million in the first nine months of 2021 to EUR 46.8 million in 2022, which is a 39.8% increase, and which is in line with the increase in the adjusted EBITDA (increase of 28.3% as compared to the previous period).

The acquisition of ASCO in 2022 is dilutive to the margin with roughly ~EUR 0 million of EBITDA and consolidated Net Sales of ~EUR 120 million in the first nine months 2022.

This increase in EBITDA can largely be attributed to the substantial improvement in Production Output (Net Sales plus Change in Finished Goods; + EUR 361.3 million), which was supported by the gain in market share and higher build rates in 2022 as well as the strengthening of the workforce to approximately 7,210 employees. The cost of materials, supplies and services (EUR 620.8 million in the first nine months 2022 vs. EUR 408.2 million in the same period in 2021) as well as personnel expenses (EUR 195.1 million for the period ended September 2022 vs. EUR 123.5 million in the same period 2021) continued to rise, which slightly dampened the effect. However, Montana Aerospace continues to see the access to skilled and qualified personnel and enough raw material as crucial milestones to achieve growth in the future.

The largest adjustments to EBITDA in 2022 were the costs related to the management stock option program (MSOP) (EUR 3.6 million), followed by lawsuit expenses (EUR 3.0 million) as well as merger and acquisition (M&A) and post-merger Integration (PMI) expenses related to the acquired ASCO group and the acquired São Marco, which sum up to EUR 1.8 million.

Segment sales and EBITDA performance in the first nine months in 2022 show that while some challenges may still lie ahead, many key challenges have already been mastered: Aerostructures as a key driver of Montana Aerospace’s business expansion posted growth of 120.1% with a total revenue of EUR 433.8 million and an adj. EBITDA of EUR 36.4 million, leaving many hurdles of 2021 behind (like low build rates of OEMs). E-Mobility also continues to raise its sales on a year-on-year comparison by 68.3%, which translates into EUR 140.8 million sales in the first nine months of 2022. The adj. EBITDA further grew by 163.6% as compared to the same period in 2021. Energy reported revenues of EUR 348.6 million and an adj. EBITDA of EUR 10.0 million, driven mainly by the Chinese and American markets.

The trend reversal and the ramp-up seen in the industry continue to drive growth. This is seen in the development of year-on-year figures in all three of our segments: Aerostructures will further expand with a high double-digit growth rate in 2022, restoring Aerospace to the rank as the largest segment in terms of absolute sales by the end of 2022 ahead of Energy and E-Mobility, both of which also will keep increasing sales at double-digit growth rates this year.

On a reported level, the operating result (EBIT) reached EUR -29.1 million as of 30 September 2022 compared to EUR -19.2 million in the first nine months of 2021, on the back of the one-off and non-operative effects mentioned above. Taking these adjustments into account, the adjusted EBIT would amount to EUR -20.7 million.

Total expenses for depreciation and amortization aggregated to EUR 75.8 million in the first nine months of 2022 as compared to EUR 52.6 million in the same period in 2021. This increase reflects the ongoing commitment to invest into new and improved production capacities. No adjustments to depreciation and amortization (impairment) were made.

Operating Result (EBIT)

On a reported level, the operating result (EBIT) reached EUR -29.1 million as of 30 September 2022 compared to EUR -19.2 million in the first nine months of 2021, on the back of the one-off and non-operative effects mentioned above. Taking these adjustments into account, the adjusted EBIT would amount to EUR -20.7 million.

Total expenses for depreciation and amortization aggregated to EUR 75.8 million in the first nine months of 2022 as compared to EUR 52.6 million in the same period in 2021. This increase reflects the ongoing commitment to invest into new and improved production capacities. No adjustments to depreciation and amortization (impairment) were made.

OUTLOOK 2022/23 – FOCUS ON FCF GENERATION & DELEVERAGING

Guidance

Montana Aerospace is able to materialize the potential it has built up in recent years through the current general market situation. While challenges such as energy cost price hikes, broken global supply chains and the general fight for talent also impact us, we are convinced that due to our unique positioning – strengthened specifically by our one-stop-shop concept, high vertical integration and the local-to-local approach – we will be able to deliver when others can not.

‘Aerostructures’ is expected to be the main driver of growth in 2022 and the coming years, with Net Sales of roughly EUR 550 million, followed by our ‘Energy’ segment with Net Sales of EUR 420 million, and ‘E-mobility’ with Net Sales of EUR 190 million. Our adj. EBITDA will reach a high double-digit EUR million figure, representing significant profitability growth and confirming that we are on the right track. In line with our strategy, CAPEX will decrease compared to the previous year, amounting only to EUR ~80 million in 2022, with the mid- to long term focus to only spend sustainable CAPEX (machine maintenance and repair) in the amount slightly higher than half of yearly D&A, as installed capacity allows to further grow massively without large new investments.

Net Debt peaked in Q3 2022 but will be reduced to a level of maximum 2.5x Net Debt / EBITDA mid-term.

Free Cash Flow

As Montana Aerospace has invested more than EUR 600 million (2018-today) into new capacities and capabilities in the last years, Free Cash Flow (FCF) generation and Net Income have been negative in the past years. Nonetheless, FCF will reflect our positive trajectory as well, which is particularly driven by the increased visibility on industry development, allowing us to – more and more – slowly reduce the raw material stock to a normal level, while keeping us prepared for potential additional work packages we might be able to take over from weaker competitors. In combination with the strong performance on the operating side, synergy effects from the ASCO acquisition and normalizing CAPEX, this will produce a positive FCF from FY 2023 onwards.

Energy Costs & Raw Material

Energy cost inflation is still the hot topic in the industry and overall market environment. In a normal year, Montana Aerospace has around EUR 17m of energy costs (FY 2021). For this year we calculate with a quadrupling of energy prices, amounting to EUR 70m of energy costs. We are able to pass through around two thirds of the increase in energy cost, however, this is connected to a lot of discussions with our customers and happens with some time-lag. That implies, that of the additional costs, Montana Aerospace has to bear roughly EUR 20m on its own. Although levels are stabilizing at a higher level, this trend will continue at least for the first half-year 2023.

Concerning raw material, risks for Montana Aerospace are relatively minor due to our high recycling capability / vertical integration in aluminium (100% of internal scrap is recycled; 70% of all aluminium used is recycled material) as well as strong inventory and secured supply for titanium. Additionally, pass-through mechanisms for all major materials (100%) of any price increase are in place.

Inventory

The level of working capital has been over proportional, but strategically intended high within 2022 and reached the peak per Q3 2022. Montana Aerospace initiated in the last weeks and months a clear commitment, to normalise the working capital on to more sustainable levels within the coming months and quarters as more visibility on material availability and slow easing of supply chain issues is visible.

Ramp-Up

We are now finalizing the last ramp-up steps of our major CAPEX programmes, which consisted of over EUR 600 million investments since 2018, particularly in our Romanian-and Vietnam-based greenfield sites. After the finalization of the tremendous CAPEX programmes, we will focus on sustainable CAPEX (machine maintenance and repair) in the amount slightly higher than half of yearly D&A.

With the acquisition of ASCO (closing on 31st March 2022) Montana Aerospace estimates roughly EUR 150 million of Net Sales contribution for FY 2022 (9 months contribution) and no major EBITDA contribution due to post-merger integration costs. Additionally, we are sticking to our long-term guidance, bringing ASCO back to EUR 300m of Net Sales with an EBITDA margin of 15% (+ additional 5% of synergy potential, through removal of external suppliers and internalisation of work). With its engineering development / design office, ASCO has recognized competences in Wing movables engineering and is already active on the ‘Wing of Tomorrow’ together with Airbus. Integration is fully on track and first synergies with Montana are being put in place with the elimination of external pre-suppliers and internalizing and thus providing the prefabricated products internally. Certification of internalizing work packages is currently ongoing as processes need to get recertified by the OEMs.

Following the closing of the merger of São Marco in September 2022 with our current ‚Energy‘ operations in Brazil, the synergies from the verticalization, combined with a strong positioning in the Americas and a dedicated and capable team, will enable us to continue to develop innovative and sustainable solutions with our customers in the growing energy and e-mobility markets. Sao Marco will provide Net Sales contribution in the amount of ~EUR 20m for FY 2022 (3 months contribution).

9M 2022 – SELECTED KEY FIGURES

You can find the full report on 9M 2022 at https://www.montana-aerospace.com/en/investors/ or directly here for reading