Montana Aerospace AG (the “Company”) and its operating subsidiaries (the “Group”

or “Montana Aerospace”), a leading, highly-vertically integrated manufacturer and

supplier of system components and complex assemblies for the aerospace, e-mobility

and energy industries with worldwide engineering and manufacturing operations,

publishes its HY1 2022 results today, with the increased industry demand and the

interesting opportunities ahead being clearly visible in the published results.

HIGHLIGHTS HY1 2022

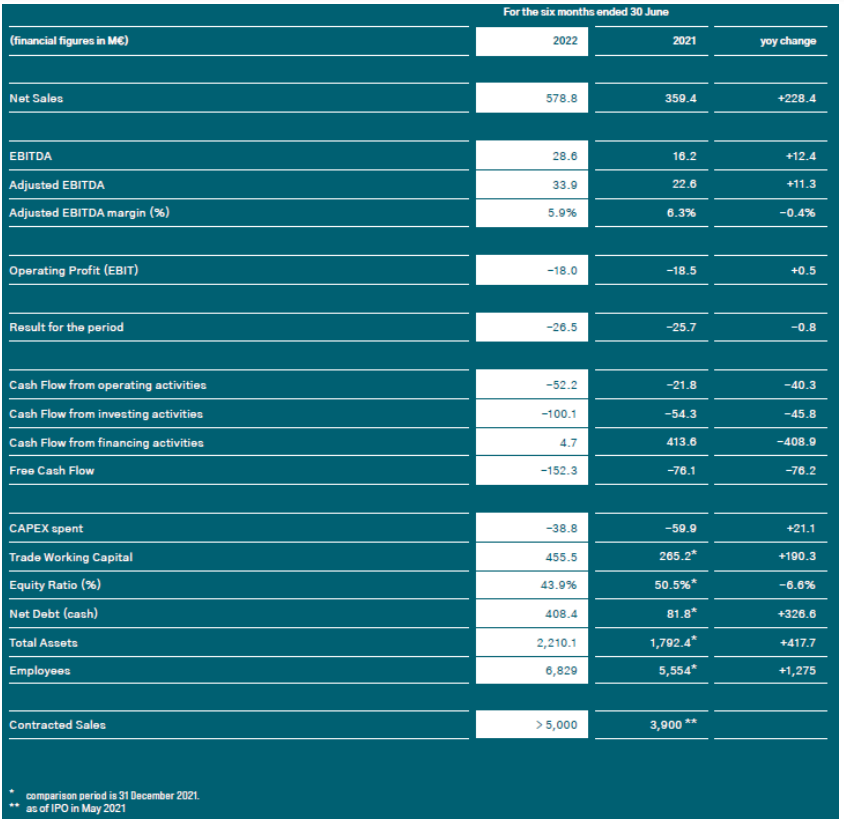

▪ Financials: Net Sales grew by 61.1% YoY to EUR 578.8 million; adj. EBITDA

performance in line with guidance, reaching EUR 33.9 million (+50.0% YoY) and

emphasising the Groups strong position in the current market environment,

especially in the ‘Aerostructures’ segment

▪ Segment Net Sales: ‘Aerostructures’ (+119.9%), ‘E-Mobility’ (+71.7%) and

‘Energy’ (+21.3%)

▪ Segment adj. EBITDA: ‘Aerostructures’ (+117.1%), ‘E-Mobility’ (+281.0%) and

‘Energy’ (-48.3%)

▪ Guidance confirmed again/slightly increased: with around EUR ~1.16 billion of

sales in 2022 (thereof ~85% organic- and ~15% inorganic growth) and an adj.

EBITDA of a high euro double-digit figure in the millions, our guidance for 2022 is

confirmed once again; the slight increase in sales guidance is due to the closing of ASCO Industries faster than expected, now contributing 9 months of sales rather

than the initially expected 6 months

▪ Contracted sales: we have been able to significantly increase the contracted sales

volume compared to the IPO, from EUR 3.9bn as of May 2021 to more than EUR

5.0bn end of June 2022; winning market share especially for the A320 family due to

the acquisition of ASCO Industries and its unique positioning in that particular

aircraft; contracted sales still based upon lower build rate estimates

▪ Management team: newly structured and highly experienced management team

with Co-CEO Kai Arndt (‘Aerostructures’), Co-CEO (‘Energy’ & ‘E-Mobility’) and

CFO Michael Pistauer and CHRO Silvia Buchinger are forming the management

board since July and will keep the Company on its growth path

▪ Build rates: strong increase in demand from airlines due to accelerated return of

appetite from passengers for flights demanding narrowbody aircrafts; forward

looking guidance still based on reduced build rate estimate compared to OEM

announcements to account for supply chain uncertainty (i.e. taking a build rate of 63

for the A320 family in 2025 rather than the announced rate of 75); nonetheless full

flexibility if demand comes quicker without any major CAPEX investments & hiring of

new employees

▪ M&A: successful closing of the acquisition of 100% of the shares of S.R.I.F. NV in

Belgium (“Asco”) on 31st March 2022; additionally, following approval by the

relevant regulatory and antitrust authorities, the combination of São Marco with the

company’s current ‘Energy’ operations in Brazil can now be completed to co-create

further innovative and sustainable solutions in close collaboration with our

customers

▪ Promissory Notes: successful placement of promissory notes with a duration of up

to five years and a volume of approximately EUR 80 million to further strengthen the

group’s financing of the growth over the next few years and replace the current

short-term financing

▪ Ramp-Up: final steps of ramp-up of major CAPEX programme of the last years (>

EUR 600 million of investments since 2018); besides finishing the ramp-up of our

two large sites in Romania and Vietnam, successful commissioning and first testing

for three new extrusion lines: large diameter extrusion press, titanium extrusion and

drawn tube

▪ Energy Costs: energy costs remain stable at a high level (about 3x as much as in the

previous year); able to pass through roughly two thirds of these costs, around one

third of the additional costs need to be borne by ourselves

▪ Inventory: over proportional but strategically intended high inventory necessary to

keep with the ramp-up in the ‘Aerostructures’ segment

▪ Transportation Costs: transportation costs have also doubled compared to the

previous year; nevertheless, we are comparatively less affected by this development

due to the high vertical integration

▪ Covenants: no covenants on Montana Aerospace AG level; guarantee on all

promissory notes of Montana Aerospace through Montana Tech Components (which

have covenants in place)

OPERATIONALLY ON TRACK IN HY1 2022

Net Sales

In the first half-year of 2022, Montana Aerospace generated consolidated Net Sales of

EUR 578.8 million, which is 61.1% above the previous year’s EUR 359.4 million, reversing on

the Covid related decline and greatly surpassing pre-Covid levels. While all sectors showed

improvements, Q2 recovery versus 2021 numbers was strongest in ‘Aerostructures’, closely

followed by ‘E-Mobility’. This favourable development was aided by Montana Aerospace’s

acquisition of ASCO group, which contributed EUR 59.6 million to Net Sales in 2022.

EBITDA

Adjusted for one-off and non-operative effects – most notably the management stock option

program (MSOP) and the acquisition of ASCO – the adjusted EBITDA reached EUR 33.9

million in the first six months in 2022, well above the level of EUR 22.6 million in the same

period in 2021. This translates into an adjusted EBITDA margin of 5.9% as compared to the

previous year’s HY1 level of 6.3% and the full year level of 7.1%. On a non-adjusted level,

reported Group EBITDA increased from EUR 16.2 million in the first half of 2021 to EUR 28.6

million in 2022, which is a 76.5% increase, and which is in line with the increase in the

adjusted EBITDA (increase of 50.3% as compared to the previous period).

This increase in EBITDA can largely be attributed to the substantial improvement in

Production Output (Net Sales plus Change in Finished Goods; + EUR 222.2 million), which

was supported by the gain in market share and higher build rates in 2022 as well as the

strengthening of the workforce to approximately 6.829 employees (largely due to the newly

acquired ASCO group). The cost of materials, supplies and services as well as personnel

expenses were higher in comparison to Q1 2022 (EUR 393.3 million vs. EUR 265.2 million

and EUR 122 million vs. EUR 78.9 million respectively), dampening the effect slightly. Yet,

Montana Aerospace continues to see the access to qualified personnel and enough raw

material as crucial milestones to achieve growth in the future.

The largest adjustments to EBITDA in 2022 were the costs related to the MSOP (EUR 2.5

million), followed by lawsuit expenses (EUR 1.6 million) as well as merger and acquisition

(M&A) and post-merger Integration (PMI) expenses related to the acquired ASCO group,

which sum up to EUR 1.2 million.

Operating Result (EBIT)

On reported level, the operating result (EBIT) reached EUR -18.0 million as of 30 June 2022

compared to EUR -18.5 million in the first six months of 2021, on the back of the one-off and non-operative effects mentioned above. Taking these adjustments into account, the

adjusted EBIT would amount to EUR -12.7 million.

Total expenses for depreciation and amortization aggregated to EUR 46.6 million in the first

six months of 2022 as compared to EUR 34.7 million in the same period in 2021. This

increase reflects the ongoing commitment to invest into new and improved production

capacities. No adjustments to depreciation and amortization (impairment) were made.

Net Sales and adj.

EBITDA development per segment

In the first six months 2022, Montana Aerospace generated consolidated Net Sales of EUR

578.8 million, which is 61.1% above the previous year’s EUR 359.4 million, reversing on the

Covid related decline and surpassing pre-Covid levels. Additionally, adj. EBITDA is up by

50.3%, amounting to EUR 33.9 million.

Segment sales and EBITDA performance in 2022 show that we have mastered the key

challenges: ‘Aerostructures’ as a key driver of our business expansion posted growth of

119.9% with a total revenue of EUR 257.5 million and an adj. EBITDA of EUR 26.7 million,

leaving the hurdles of 2021 behind. ‘E-Mobility’ raised its Net Sales by 71.7%, further

delivering a positive result after ramping up the third plant and generating total Net Sales of

EUR 94.6 million at an adj. EBITDA of EUR 8.0 million. ‘Energy’, driven by the high demand

by infrastructural projects, reported Net Sales of EUR 227.4 million at an adj. EBITDA of EUR

3.1 million, a slight decline from Q2 2021 adj. EBITDA of EUR 6.0 million as passing on

energy price increases to customers is lagging 6 months. Positive impact of price increases

should be shown from July 2022 onwards.

OUTLOOK 2022

Guidance

Currently, Montana Aerospace is able to materialize on the situation of the general market.

Although there are some hurdles that need to be tackled (like energy cost inflation,

disruption of supply chains or the fight for talent), Montana Aerospace remains confident to

be able to leverage its strong position as a one-stop-shop in the aerospace industry and win

a larger stake in the overall market through its ability to deliver when others can’t.

Updated full year sales guidance of around EUR ~1.16 billion for 2022 confirmed, with

‘Aerostructures’ as key driver of growth, expecting sales of around EUR ~550 million,

‘Energy’ sales of EUR ~420 million and ‘E-Mobility’ sales of EUR ~190 million (~85%

growth organically and ~15% inorganically). Concerning profitability (adj. EBITDA), we

continue to expect a high double-digit EUR million figure. CAPEX should decrease compared

to 2021 to around EUR ~90.0 million in 2022, focusing more and more only on sustainable

CAPEX over the mid- to long-term.

Inventory

Montana Aerospace has consequently built up inventories within the last months in order to

safeguard production over the next quarters. Some are not able to deliver due to constraints

in material availability, lack of manpower or supply chain constraints. In contrast to that, we

are ready to jump into contracts where others for instance fail to deliver titanium or

aluminum parts. Therefore, working capital remains over proportionally high this year, with

our expectation of this being still the case until early 2023.

Ramp-Up

We are currently in the final stages of finalising the major investment programmes that we

started in 2018 (> EUR 600 million). In addition to the ramp-up of the two large plants in

Romania and Vietnam, a large part of this volume went into the construction of the three new

extrusion lines, which have successfully completed their test phase and will make significant

contributions to sales and earnings in the future. In addition to the commissioning of a drawn

tube for special alloys and an extrusion line for titanium and carbide profiles, one of

Europe’s largest and most efficient large-format extrusion lines for the production of

aluminium wing structures was also put into operation. These lines are already in the

qualification process with major OEMs and are expected to go into serial production by the

end of 2022.

Integration of ASCO & Sao Marco

The integration of ASCO is fully on track. The balance sheet of Montana Aerospace already

shows the complete transaction of Asco Industries whereas the income statement shows

only 3 months of contribution. While Montana Aerospace offers a high vertically integrated

value chain, ASCO focuses more on its Tier-2 to Tier-1 status as a system provider for the

large OEMs. For this reason, ASCO’s value chain is also dependent on external suppliers in

the preliminary stages of production. This is exactly where our integration strategy comes in

and we believe that we can leverage accretive synergy potentials by replacing external suppliers with internal provision of resources. The challenge here currently lies in the fact that we need to integrate all external processes. However, we are already on the right track

with the two major OEMs and the approval process.

Following approval by the relevant regulatory and antitrust authorities, the merger of São

Marco with the Company’s current ‚Energy‘ operations in Brazil can now be completed. The

synergies from the verticalisation, combined with a strong positioning in the Americas and a

dedicated and capable team will enable us to continue to develop innovative and sustainable

solutions with our customers in the growing energy and e-mobility markets.

Promissory Notes

In June, Montana Aerospace placed promissory notes in the amount of ~EUR 80 million on

the capital markets via a bank consortium. The four tranches have a term of three or five

years (the focus is on five years). Despite the current market volatility the tranches were

heavily oversubscribed, partly due to international investor demand. The funds are available

to the Company for general financing projects and will thus be used, among other things, to

further accelerate the Company’s growth following the acquisition of the Belgian ASCO

Group.

Energy Costs & Raw Material

Current times are challenging on the utility markets. In the 1st quarter alone, Montana

Aerospace had do digest already ~EUR 10m of energy costs, compared to only ~EUR 3m in

the same period the year before. This remained the same for the second quarter 2022 and

will also continue throughout the year. Montana Aerospace can pass through the majority of

these price increases (with a time lag) but nonetheless needs to bear around one third of

any additional incremental cost (already reflected in our guidance).

Raw material constraints are not a major issue for Montana Aerospace due to its high

vertical integration and recycling capabilities (especially for aluminum but also titanium).

Additionally, in recent weeks and months, we have consciously focused on building up

inventories to ensure greater independence from current supply chain bottlenecks, including

inventories that maintain production in certain areas for about 18 months.

Kai Arndt, Co-CEO of Montana Aerospace says: “Despite all the challenges and headwinds

that have arisen in the aviation market in recent months, we are proud that we have been

able to deliver on our ambitious targets in terms of revenue and profitability and secure

further market share through our unique positioning as the one-stop-shop in the aerospace

supply chain. We continue to work 24/7 to successfully develop the company and would like

to thank all our employees for their dedication and hard work as well all our stakeholders

once again for the trust they have placed in us.”

HY1 2022 – SELECTED KEY FIGURES

You can find the full report on HY1 2022 at https://www.montana-aerospace.com/en/investors/