Montana Aerospace AG (the “Company”) and its operating subsidiaries (the “Group” or “Montana Aerospace”), a leading, highly-vertically integrated manufacturer and supplier of system components and complex assemblies for the aerospace-, e-mobility- and energy industry with worldwide engineering and manufacturing operations, today publishes its 9M 2023 results.

HIGHLIGHTS 9M 2023

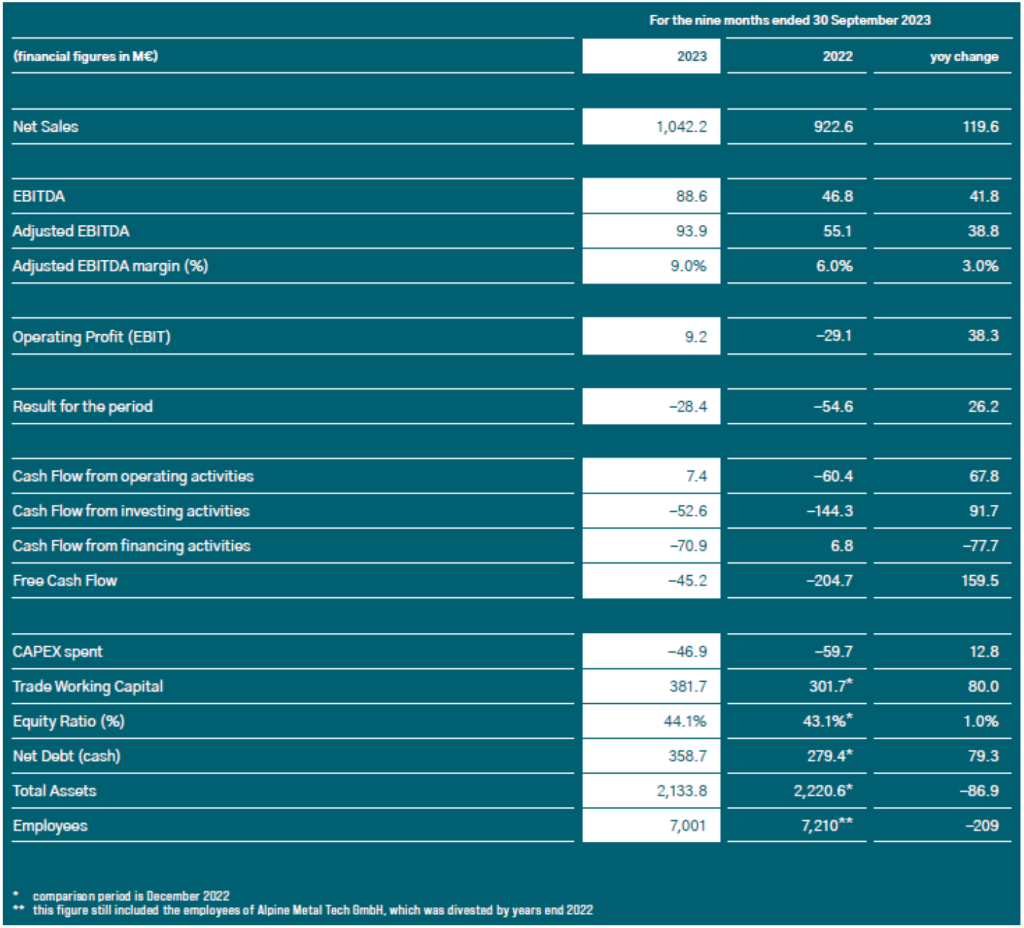

- Financials: Net sales grew by 13.0% to EUR 1,042.2 million; adjusted EBITDA1 rose by EUR 38.8 million to EUR 93.9 million (+70.4%) through strong developments in all segments; positive free cash flow generation in Q2 (EUR 27.0 million) followed by positive free cash flow generation in Q3 (EUR 30.1 million) on a standalone basis

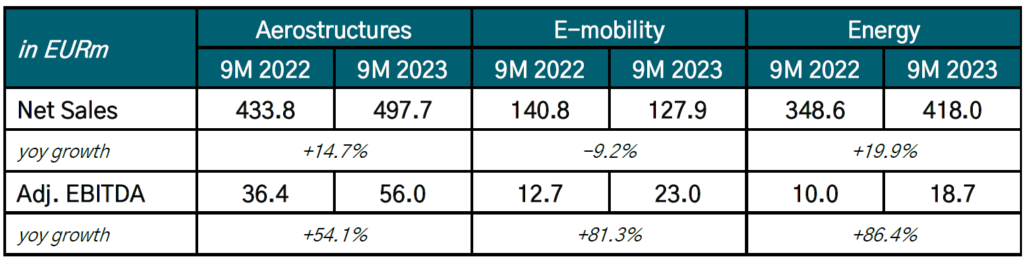

- Segment net sales: Aerostructures: +15%, E-Mobility: -9%, Energy: +20%

- Segment adj. EBITDA: Aerostructures: +54%, E-Mobility: +81%, Energy: +86%

- Guidance reconfirmed: >EUR 1.5 billion net sales and an adj. EBITDA in the range of EUR 130-150 million; clear goal of generating a positive free cash flow and net income; therefore, Montana Aerospace reconfirms its guidance for FY 2023

- Guidance 2024: Montana Aerospace expects solid net sales of ~EUR 1.7 billion for 2024 and an adj. EBITDA in the range of EUR 180-200 million; clear goal of generating a positive free cash flow and net income in FY 2024

- Successful refinancing / ring-fencing implemented: Montana Aerospace AG successfully signs new syndicated term loans in the amount of EUR 450 million – establishing an independent debt financing structure, streamlining its balance sheet and strengthening its credit worthiness through strict ring-fencing (See ad-hoc announcement of November 10th, 2023)

FULL YEAR GUIDANCE RECONFIRMED

The results of the first nine months of 2023 are in line with our guidance in the Aerostructures and E-Mobility segments and exceeding our internal expectations in the Energy segment. Among the highlights of the financial results for 9M 2023 are the net sales figures of the Aerostructures segment, which amount to EUR 497.7 million (+14.7% yoy), and the adj. EBITDA figures of all segments (Aerostructures +54%, E-Mobility +81% and Energy +86% yoy).

NET SALES

In the first nine months of 2023, Montana Aerospace generated consolidated net sales of EUR 1,042.2 million, which is +13% above the previous year’s EUR 922.6 million. The greatest contribution to net sales was generated by the business segment Aerostructures, which achieved EUR 497.7 million, closely followed by the business segment Energy (EUR 418.0 million). E-mobility showed a major loss in net sales compared to last year’s development due to limited sales of billets (recycling of aluminum) in the external market. The major part of the positive net sales development was driven organically, yet it was supported by Montana Aerospace’s acquisitions of ASCO in the Aerostructures business segment and Sao Marco in the Energy business segment (both in 2022). Additionally, the loss of net sales through the divestiture of the machine building capacity Alpine Metal Tech by the end of 2022 needs to be considered. Overall, Montana Aerospace showcases a constantly strong order to bill ratio of >1.

EBITDA

Accounting for one-off and non-operative effects – most notably legal costs and post-merger integration (PMI) related expenses – the adjusted EBITDA reached EUR 93.9 million in the first nine months in 2023, exceeding the level of EUR 55.1 million in the same period in 2022.

This translates into an adjusted EBITDA margin of 9% as compared to the previous year’s 9M level of 6%. Overall adj. EBITDA performance is still impacted and diluted by external supply chain issues which ASCO is facing within the Aerostructures segment on its path to full integration.

On a non-adjusted level, reported Group EBITDA increased from EUR 46.8 million in the first nine months of 2022 to EUR 88.6 million in the same period of 2023, which is a +89.6% increase and in line with the growth of adjusted EBITDA (+69.8% compared to 9M 2022). Comparing the adjusted EBITDA of Q3 2023 on a standalone basis (EUR 33.0 million) with the same figure Q3 2022 (EUR 18.1 million), this results in a near doubling (+82.3%).

The growth of cost of materials supplies and services (EUR 659.8 million in the first nine months 2023 vs. EUR 620.8 million in the same period in 2022) is under-proportional to the net sales development. Important economies of scale were achieved as personnel expenses did not grow proportional to net sales (EUR 212.3 million for the period ended September 2023 vs. EUR 195.1 million in the same period 2022). We guide for a continuation of this trend.

The four adjustments to EBITDA in the first nine months in 2023 were the costs related to PMI expenses related to the acquired ASCO group in 2022, amounting to EUR 0.9 million, followed by legal costs of EUR 2.4 million, the management stock option program (MSOP) of EUR 1.7 million as well as the preparation costs for the potential ASTA IPO of EUR 0.3 million. Overall, these elements sum up to EBITDA adjustments of EUR 5.3 million.

NET SALES AND ADJ. EBITDA DEVELOPMENT PER SEGMENT

Segment sales and EBITDA performance in the first nine months in 2023 show Aerostructures and Energy as the key drivers of Montana Aerospace’s business expansion. Aerostructures posted growth of +14.7% with a total revenue of EUR 497.7 million, while Energy showed significant growth of +19.9% with a total revenue of EUR 418.0 million. The E-Mobility segment reported lower net sales (EUR 127.9 million in the first nine months in 2023 vs. EUR 140.8 million in the same period in 2022) due to limited sales of billets (recycling of aluminum) in the external market.

Nonetheless, adjusted EBITDA in the E-Mobility segment has been able to offset lower top line through long-term contracts, strict cost management and the focus on the margin-accretive legacy business. The Energy segment achieved an impressive adjusted EBITDA of EUR 18.7 million, which is +86.4% compared to 9M 2022. Energy is establishing itself as a business segment with constant strong growth and gaining very strong tailwind in a structurally changing market environment. Aerostructures also reported an improvement of +54.1% compared to the same period last year and posted an adjusted EBITDA of EUR 56.0 million, although still dilutive on overall adjusted EBITDA due to ongoing supply chain challenges within ASCO. The clear focus in Aerostructures is to utilize its potential for economies of scale and to generate an over proportional EBITDA contribution to net sales.

TRADE WORKING CAPITALS

Concerning trade working capital (TWC), we expect to reach significantly lower and more sustainable TWC levels in all segments, as guided previously, until the end of 2023 and beyond. As net sales rose by ~13%, inventories only rose by roughly 7%, serving as a proof of our effective trade working capital management.

FINANCIAL RESULTS

The financial result was negatively impacted due to substantially higher interest expenses and hiked from EUR -19.5 million (end of September 2022) to EUR -39.7 million at the end of September 2023. Nonetheless, within the financial result, more than one third of the amount relates to non-cash related items (foreign exchange (FX) positions). The combination of the new syndicated loan and the cash usage of up to EUR 200 million for the repayment of existing debt reduces the total gross debt by the same amount, further strengthening the balance sheet and reducing interest expenses

STRICT RING-FENCING CONCEPT IMPLEMETED

Montana Aerospace AG successfully signed a new syndicated term loan in the amount of EUR 450 million which is provided by a syndicate of banks. The tranches consist of a term loan of EUR 300 million, which is used for the repayment of current outstanding promissory notes (which have been guaranteed by the majority shareholder Montana Tech Components AG) as well as a revolving credit facility in the amount of EUR 150 million. All tranches are unsecured and contain certain financial covenants (net debt/EBITDA and equity ratio) on the Montana Aerospace level, without any linkages to its majority shareholder or its other shareholdings. The maturity of all tranches is three years (See ad-hoc announcement of November 10th, 2023).

OUTLOOK 2023/2024

GUIDANCE RECONFIRMED

Facing the positive results of 9M 2023, Montana Aerospace is confident to achieve its 2023 annual targets. We continue to expect total net sales to rise above EUR 1.5 billion in FY 2023, and guide for our company’s adjusted EBITDA to be in the range of EUR 130 to 150 million.

Regarding our business units, the Aerostructures segment is set to be the main driver with projections for net sales of ~EUR 800 million, followed by Energy with net sales of EUR >550 million and E-mobility with net sales of ~EUR 200 million. As Q2 and Q3 have already generated a positive operative and free cash flow on a stand-alone basis, we reconfirm the guidance that the Montana Aerospace Group will generate a positive free cash flow and net income for the full year 2023.

Montana Aerospace expects solid net sales of ~EUR 1.7 billion in 2024 and an adjusted EBITDA in the range of EUR 180 to 200 million. We have a clear goal of generating a positive free cash flow and net income by materializing on the major ramp-up and over proportionally benefiting from the anticyclical investments that have been done over the past years. Aerostructures will remain the main driver with projections for net sales of EUR >950 million, followed by Energy with net sales of EUR >580 million and E-mobility with net sales of EUR >200 million.

9M 2023 – SELECTED KEY FIGURES

The full 9M 2023 report is available online at (click here)

A conference call with Co-CEO and CFO Michael Pistauer will take place today from 02:30 – 03:30pm CET. Participants may pre-register and will receive dedicated dial-in details to easily and quickly access the call: (click here). The respective 9M 2023 earnings presentation can be found shortly prior the call on the website in the “Investor Relations” section.

1 ‘Adjusted EBITDA’ as EBITDA (earnings before interest, taxes, depreciation and amortization) adjusted for legal costs (mainly for the Arconic lawsuit), the management stock option program, M&A and post merger integration (PMI) related expenses as well as the ASTA IPO preparation costs – numbers and reconciliation can be found on page 24 in the 9M interim financial statement 2023, available at (click here)

About Montana Aerospace AG

Montana Aerospace AG is a leading manufacturer of system components and complex assemblies for the aerospace industry, with worldwide engineering and manufacturing operations. The Company has approximately 7,000 highly skilled employees at 22 locations on four continents – designing, developing and producing ground-breaking technologies for tomorrow’s aerospace, E-Mobility and energy industries made of aluminium, titanium, composite, copper and steel.

Disclaimer

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO ANY JURISDICTION WHERE TO DO SO WOULD BE UNLAWFUL.

FOR RELEASE IN SWITZERLAND – THIS IS A RESTRICTED COMMUNICATION AND YOU MUST NOT FORWARD IT OR ITS CONTENTS TO ANY PERSON TO WHOM FORWARDING THIS COMMUNICATION IS PROHIBITED BY THE LEGENDS CONTAINED HEREIN.

Statements contained herein may constitute “forward-looking statements”. Forward-looking statements are generally identifiable by the use of the words “may”, “will”, “should”, “plan”, “expect”, “anticipate”, “estimate”, “believe”, “intend”, “project”, “goal”, “aim” or “target” or the negative of these words or other variations of these words or comparable terminology.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other factors that could cause the Company’s or its industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. The Company does not undertake publicly to update or revise any forward-looking statement that may be made herein, whether as a result of new information, future events or otherwise.