Montana Aerospace AG (the “Company”) and its operating subsidiaries (the “Group” or “Montana Aerospace”), a leading, highly-vertically integrated manufacturer and supplier of system components and complex assemblies for the aerospace, E-Mobility and energy industries with worldwide engineering and manufacturing operations, publishes its Q1 2022 results today, supporting further sustainable growth of the Group.

HIGHLIGHTS Q1 2022

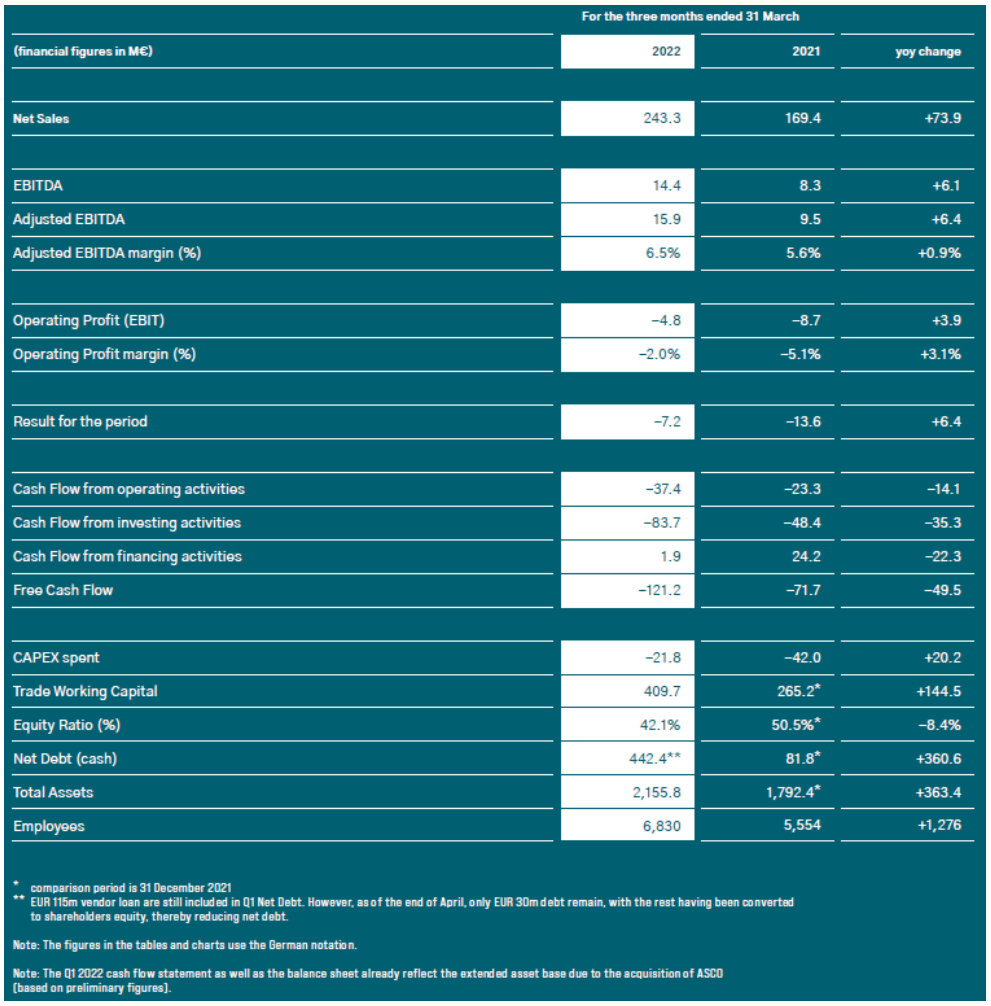

- Financials: Net sales grew by 43.6% to EUR 243.3 million YoY; adj. EBITDA performance in line, reaching EUR 15.9 million (+68.2% YoY) and emphasising the Groups strong and sustainable recovery from the Covid-19 crisis

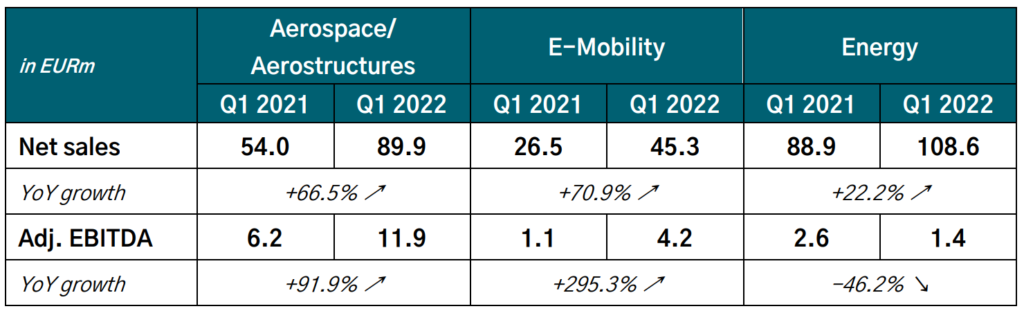

- Segment Sales: Aerospace (+66.5%), E-Mobility (+70.9%) and Energy (+22.2%)

- Segment adj. EBITDA: Aerospace (+91.9%), E-Mobility (+295.3%) and Energy (-46.2%)

- CAPEX: Capital expenditure investments of EUR 21.8 million in Q1 2022 compared to EUR 42.0 million in Q1 2021; total amount invested since 2018 >EUR 580 million, giving a significant head start and strengthening our resilience against market turbulence amidst current market uncertainties

- Guidance confirmed: With around EUR 1.1 billion of sales in 2022 (thereof ~85% organic- and ~15% inorganic growth) and an adj. EBITDA of a high double-digit EUR million figure, guidance once again confirmed for 2022

- New Contracts: The Aerospace segment is currently working on several contracts in support of the extrusion business growth and continues to add incremental work packages, that align with open capacity and core competencies, to the detailed parts business; order development year-to-date has been strong, with an order-tobill ratio of ~1,25x in Q1

- Build Rates: Sharp increase in demand from major aircraft manufacturers, whose build rates continue their recovery towards pre-pandemic levels; management view on build rates unchanged; internal assumptions already more conservative than OEM announcements

- M&A: Closing of the acquisition of 100% of the shares of S.R.I.F. NV in Belgium (“Asco”) on 31st March 2022, adding 1,100 employees and 142k sqm of industrial surface with 4 manufacturing facilities to Montana Aerospace AG; post-merger integration well advanced, ensuring a smooth and fast implementation of Asco into our existing business operations; the Q1 2022 cash flow statement as well as the balance sheet already reflect the extended asset base due to the acquisition of ASCO (based on preliminary figures)

- Russia / Ukraine: no offices or facilities neither in Russia / Ukraine nor in gasembargoed areas like Poland or Bulgaria; sales exposure to Russia/Ukraine of less than 1% of total Group sales

OPERATIONALLY ON TRACK IN Q1 2022

Net sales

In the first quarter of 2022, Montana Aerospace generated consolidated Net sales of EUR 243.3 million, which is 43.6% above the previous year’s EUR 169.4 million, reversing on the Covid related decline and surpassing pre-Covid levels. While all sectors showed improvements, Q1 recovery versus 2021 numbers was strongest in E-Mobility, closely followed by Aerospace.

EBITDA

Adjusted for one-off and non-operative effects – most notably the management stock option program (MSOP) – the adjusted EBITDA reached EUR 15.9 million in the first three months 2022, well above the level of EUR 9.5 million in the previous period. This translates to an adjusted EBITDA margin of 6.5%, compared to the previous yearʼs Q1 level of 5.6%. On a reported basis, reported Group EBITDA increased from EUR 8.3 million to EUR 14.4 million in the first three months of 2022, in line with the increase in the adjusted EBITDA.

The largest adjustments to EBITDA in 2022 were the costs related to the MSOP (EUR 1.2m) followed by legal cost for the Arconic lawsuit (EUR 0.3m). Although sponsored by the current majority shareholder and therefore not cash relevant for Montana Aerospace, the accrued expenses are – according to IFRS – included in personnel expenses.

Operating Result (EBIT)

No adjustments were made to depreciation and amortization (impairment). On a reported level, the operating result (EBIT) reached EUR -4.8 million as of 31 March 2022 in Q1, compared to EUR -8.7 million in the previous year’s period, on the back of one-off and nonoperative effects mentioned above. The adjusted EBIT would amount up to EUR -3.3 million.

Total expenses for depreciation and amortization amounted to EUR 19.2 million in the first three months of 2022 (Q1/2020: EUR 17.0 million). The increase reflects the ongoing commitment to invest into new and improved production capacities.

Net sales and adj. EBITDA development per segment

Segment sales and EBITDA performance in Q1 2022 show that we have mastered the key challenges: Aerospace as a key driver of our business expansion posted growth of 66.5% with a total revenue of EUR 89.9 million and an adj. EBITDA of EUR 11.9 million (+ ~92%), leaving the issues of 2021 behind (like low build rates of OEMs). E-Mobility raised its revenues by 70.9%, further delivering a positive result after ramping up the third plant and generating total sales of EUR 45.3 million at an adj. EBITDA of EUR 4.2 million (+ ~295%). Energy, driven by the high material prices on the commodity markets and the high demand by infrastructural projects, reported sales of EUR 108.6 million (+ ~22.2%) at an adj. EBITDA of EUR 1.4 million (- ~46%), a slight decline from Q1 2021 adj. EBITDA of EUR 2.6 million due to post-Covid implications on the European but mainly Chinese market.

OUTLOOK 2022

Financial Performance

Full year guidance of EUR 1.1 billion for 2022 confirmed, with Aerospace as key driver of growth, expecting sales of around EUR ~500 million, Energy sales of around EUR ~440 million and E-Mobility of around EUR ~190 million. ~85% growth does come organically and ~15% inorganically. Concerning profitability (adj. EBITDA), we continue to expect a high double-digit EUR million figure. CAPEX cash-out should decrease from EUR 121.4 million in 2021 to around EUR 90.0 million in 2022, focusing more and more only on sustainable CAPEX.

Ramp-Up

In view of the strong increase in demand from the major aircraft manufacturers, whose production figures are gradually approaching pre-pandemic levels, we are ramping up our production. Thanks to the high investments in capacity expansions with new plants in Romania and Vietnam, we are now in a position to support our customers even where our competitors – due to the recent crisis years – are struggling to cope with the surge in demand. As a highly vertically integrated supplier, we are not only able to significantly reduce complexity in project execution, but also to significantly shorten delivery times.

Integration of Asco Industries

With Asco, we now have another hidden champion from the aerostructures industry on board. The integration of Asco into the ‚Aerospace / Aerostructures‘ business segment under the leadership of our COO Kai Arndt shall create significant efficiency gains and synergy effects. The integration will allow us to expand our market presence and, above all, our engineering know-how and manufacturing competencies.

Commodities

With commodity prices in the markets currently increasing rapidly, we would like to reiterate that Montana Aerospace is able to offset price inflation for most materials due to the passthrough clauses in its contracts. In addition to cost inflation, the availability of certain materials and alloys also plays an important role. Montana Aerospace focuses to mitigate procurement and supply risk through its high recycling capabilities and use of scrap materials (particularly aluminium, where up to 70% of the material used comes from recycled materials). Apart from this, in recent weeks and months we have focused on building up inventories to ensure greater independence from current supply chain bottlenecks, including inventories that maintain production in certain areas for about 18 months.

Energy

Energy prices in Europe quadrupled at the beginning of 2022. In 2021, Montana Aerospace had energy costs of €16.6 million. Although we are able to pass on (directly and indirectly) the majority of any additional costs, we still have to absorb a minority of the additional costs. The increase in energy costs is included in our forecast and guidance already. However, over the medium term, we are very ambitious and aim to increase our independence from external energy supplies and are investing into solar power installations at our Romanian production sites.

Transportation

Transport costs have multiplied in recent years and pose various challenges to global supply chains. We are prepared for high transport costs, as outbound logistics ex works are either organised by our customers themselves or the costs are borne directly by them. Only the higher inbound transport costs have to be borne by us, but these play a minor role for Montana Aerospace due to our high vertical integration and one-stop-shop concept. Based on the current price development, we expect transport costs for the entire Group to increase by a maximum of a low single-digit million EUR amount in 2022, which has already been taken into account in the guidance.

Michael Pistauer, CFO of Montana Aerospace says: “The first quarter of 2022 shows once again that we are delivering on our IPO promises and even performing beyond them. We are pleased to reaffirm our guidance for 2022 and would like to thank all our employees for their hard work and all our shareholders for their trust they place in the company every single day.”

Q1 2022 – SELECTED KEY FIGURES

Disclaimer

Statements contained herein may constitute “forward-looking statements”. Forward-looking statements are generally identifiable by the use of the words “may”, “will”, “should”, “plan”, “expect”, “anticipate”, “estimate”, “believe”, “intend”, “project”, “goal”, “aim” or “target” or the negative of these words or other variations of these words or comparable terminology.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other factors that could cause the Company’s or its industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. The Company does not undertake publicly to update or revise any forward-looking statement that may be made herein, whether as a result of new information, future events or otherwise.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, NEW ZEALAND OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD BE UNLAWFUL.

FOR RELEASE IN SWITZERLAND – THIS IS A RESTRICTED COMMUNICATION AND YOU MUST NOT FORWARD IT OR ITS CONTENTS TO ANY PERSON TO WHOM FORWARDING THIS COMMUNICATION IS PROHIBITED BY THE LEGENDS CONTAINED HEREIN.