Montana Aerospace AG (the “Company”) and its operating subsidiaries (the “Group” or “Montana Aerospace”), a leading, highly-vertically integrated manufacturer and supplier of system components and complex assemblies for the aerospace, e-mobility and energy sectors with worldwide engineering and manufacturing operations, today publishes its first half-year report after the successful IPO this May.

HIGHLIGHTS

- Robust signs of recovery from Covid-19 crisis in the aerospace sector

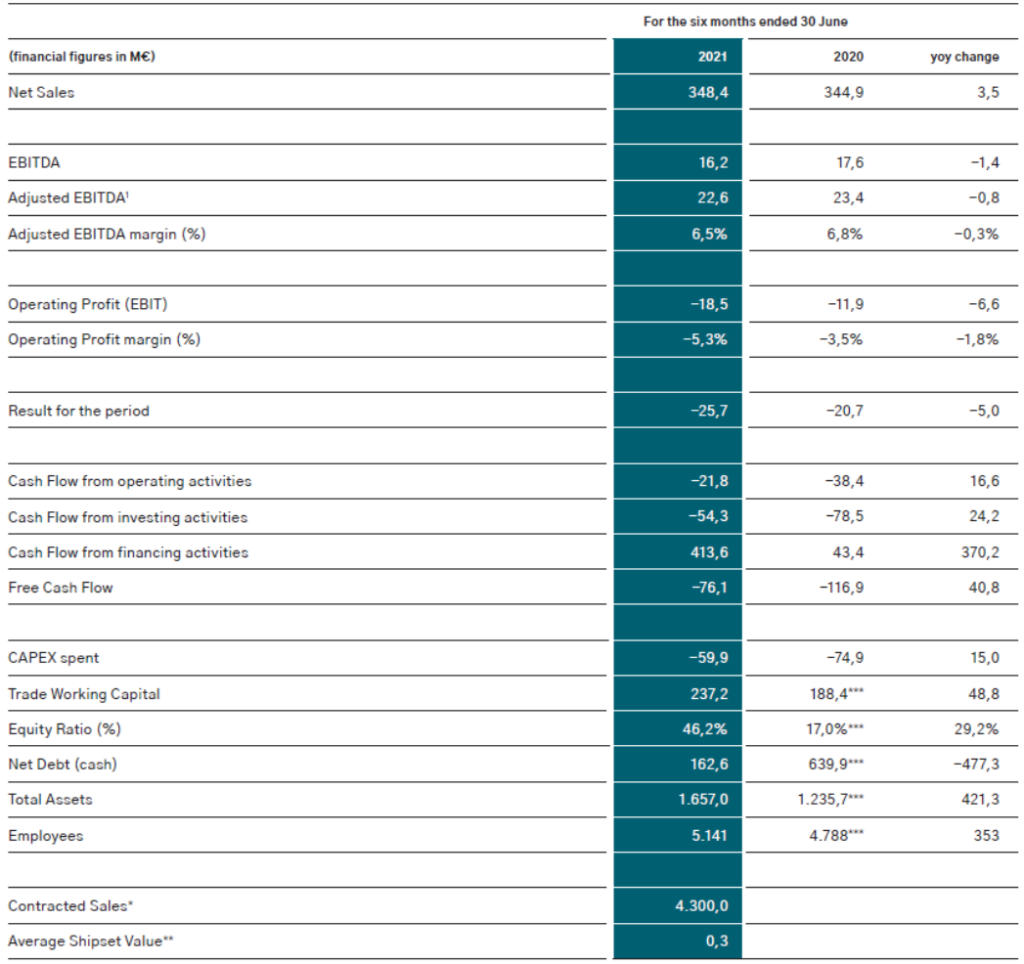

- Sales already slightly above strong first half of 2020 (+ EUR 3,5 million)

- Adjusted EBITDA almost at level of previous period – negative impact from ramp-up cost and inflation effects compensated

- Strong increase in contracted sales up to EUR 4.3 billion (+ EUR 400 million) compared to IPO

- Implementation of new investments and ramp-up of new plants in Baia Mare / RO, DaNang / VN and Mediescu Aurit / RO on schedule

- Expertise in titanium processing expanded through acquisition of French extrusion specialist Cefival in March 2021

- Full integration of specialty machinery manufacturer IH TECH in May, expanding Montana Aerospace’s expertise in automation and robotics

- Successful IPO in May 2021 providing financial flexibility for organic and inorganicgrowth opportunities – strategic M&A projects under assessment with the objective to broaden our customer, technology and product portfolios and to further vertically integrate our value chain

OUTLOOK

- For the rest of the year, we expect a constant increase in sales up to a level of around EUR 750 million (excluding any further acquisition activity)

- Additionally, there is a good chance that we achieve our M&A goals earlier than expected

- With the ramping up of new plants and the industrialization of new articles, we are prepared for higher build rates in the aerospace industry

“The signs of recovery of the aerospace industry are promising. With the significant investments made before and during the pandemic, Montana Aerospace is best prepared to participate over-proportionally from the positive trend. Our teams have done an excellent job in managing the pandemic and starting our new facilities on schedule”, says Markus Nolte CEO of Montana Aerospace.

Michael Pistauer, CFO of Montana Aerospace adds: “We are also presenting a stronger outlook for the years to come, due to higher contracted sales and increased build rates. Contracted sales have increased since the IPO by around EUR 400 million to reach a record EUR 4.3bn in Aerospace alone. The main driver for the IPO was to be an active player in an accelerating consolidation within the aerostructures business. We closed two smaller transactions in May, and – earlier than expected – finalised two binding offers / heads of terms for acquisitions, and currently we are in the middle of confirmatory due diligences. We also proceeded successfully on another acquisition and exchanged very specific letters of intent. Taken together, these acquisitions are worth around EUR 500 million in annual sales.”

OPERATIONALLY ON TRACK IN H1 2021

Results for Aerospace are above our internal expectations for H1 2021 and almost in line with adjusted EBITDA for H1 2020. Please note that the aerostructures business in H1 2020 was more or less unaffected up to May 2020, and showed record highs. H1 2021 has been characterised by considerable uncertainty surrounding the entire aerospace industry business in the first few months: there were some large announcements during the second quarter from OEMs, but demand/build rates are still very weak, albeit now steadily increasing.

With a fraction of capitalized costs in comparison to H1 2020 (EUR 5,9 million vs. EUR 22,2 million), H1 2021 showed that Production Performance (Net Sales plus Change in Finished Goods) was achieved with appreciably lower personnel costs (EUR 78,9 million vs. EUR 86,6 million) and other operating expenses. Although, Montana Aerospace is still in the process of ramping up its large new facilities (Airport Baia Mare, Romania and Da Nang, Vietnam) and industrialised around 1.500 new parts in 2021 (vs. 1.000 in H1 2020) of the new contracts, it has been able to publish a very promising result. Cash flow numbers improved substantially in comparison to 2020, enabling a sharp reduction in Net Debt from EUR 639 million to EUR 162 million as per 30.6.2021. The Equity Ratio increased from 17,0% to 46,2%, with total assets at EUR 1,6 billion. Finalisation of major Capex programmes are exactly in line with our strict timetable. Additionally, with more than EUR 24 million change in finished and unfinished goods, we are prepared for higher demands from the aerospace industry expected for the second half of 2021. In summary, we are still ramping up plants and contracts in many areas and facing a constant increase of build rates (but from a very low level). However, we feel more than prepared for the forthcoming quarters and have therefore increased our expectations for the years to follow.

SALES & SECTORS

As total net sales were able to post only a very modest increase, sector reporting presents a rather differentiated picture: Aerospace sales, with EUR 116,3 million, declined by around 27%. The first months of 2020 showed the strongest sales ever in the history of Montana Aerospace AG, mainly driven by an aerospace market still – at that time – more or less untouched from effects resulting from the COVID-19 pandemic. In H1 2021, however, build rates at Boeing and Airbus were massively down, with Airbus A320 being down -31% yoy and the A350 -52% yoy as well as Boeing’s 737 being down by -79% and the 787 by -64%. Montana Aerospace’s sales performance therefore reflects increasing sales from the ramp-up of two new plants and the large contracts won. Heavy alloy extrusion parts and structures, an essential part of our aerostructure core business, is usually an early indicator for improving aerospace business, since those structures are the primary elements when manufacturing an aircraft. After a weak start to the year, massive demand has emerged since April. In terms of vertical integration, demand and pull rates are still weaker than H1 2020, but the outlook for full year 2021 and 2022 is good. A significant improvement in build rates is driving this expectation. The largest sales contribution has been provided by Energy. Our leading market position helped us increase market share and sales (mainly in the Americas), as well as worldwide profitability. Margins in Energy rose by approx. 10%. Emobility, as indicated, not only moved from negative to positive margin levels and therefore into profitability, but also managed an increase in sales by almost 20% to EUR 54 million. Margins in Aerospace – despite being heavily affected by ramp-up costs, low build rates and lower activated costs than in 2020 – remained largely unchanged at slightly under mid-teen level.

OUTLOOK 2021 – CONFIRMING THE FULL YEAR GUIDANCE

“For the rest of the year, we expect a constant increase in sales. We expect sales for the full year of 2021 at a level of around EUR 750 million (excluding any further acquisition activity). With operative margin levels to be improved, we intend to proportionally develop profitability. With the ramping up of new plants and the industrialization of new articles we are prepared for the higher build rates in the aerospace industry, as communicated by the OEMs during recent weeks and months. There is additionally a good chance that we achieve our M&A goals earlier than expected. Still, we want to point out that higher build rates and larger contracts are still foreseen for the years 2022 to 2024. That is when explicitly higher sales and results may be expected”, says Michael Pistauer, CFO Montana Aerospace.

H1 2021 – SELECTED KEY FIGURES

Disclaimer

The information contained herein is not for release, directly or indirectly, in or into the United States of America, Canada, Australia, Japan or any other jurisdiction where to do so would be unlawful. This document (and the information contained herein) does not contain or constitute an offer of securities for sale, or solicitation of an offer to purchase securities, in Canada, Australia or Japan or any other jurisdiction where such an offer or solicitation would be unlawful. In particular, this document is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or an exemption from registration. The securities referred to herein have not been and will not be registered under the Securities Act. No public offering of the securities has been or will be made in the United States.

None of the underwriters or any of their respective subsidiary undertakings, affiliates or any of their respective directors, officers, employees, advisers, agents, alliance partners or any other entity or person accepts any responsibility or liability whatsoever for, or makes any representation, warranty or undertaking, express or implied, as to the truth, accuracy, completeness or fairness of the information or opinions in this announcement (or whether any information has been omitted from the announcement) or any other information relating to the Group, its subsidiaries or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this announcement or its contents or otherwise arising in connection therewith. Accordingly, each of the underwriters and the other foregoing persons disclaim, to the fullest extent permitted by applicable law, all and any liability, whether arising in tort or contract or that they might otherwise be found to have in respect of this announcement and/or any such statement.

This communication is not an offer to sell or a solicitation of offers to purchase or subscribe for securities. This communication is not a prospectus within the meaning of the Swiss Financial Services Act (the “FinSA”) and will not be reviewed by any competent authority. Any offer of securities of the Company will be made solely by means of, and on the basis of, a prospectus that will contain, among others, detailed information about the Company and its management, the offered securities (specifically the associated rights, obligations and risks) as well as the offer itself. This communication constitutes no advertising in the sense of article 68 of the FinSA. Such advertisements are communications to investors aiming to draw their attention to financial instruments. Any investment decisions with respect to any securities should not be made based on this advertisement. Any person considering the purchase of any securities of the Company must inform itself independently based solely on such prospectus (including any supplement thereto). The prospectus, which has been approved by a reviewing body recognised by the Swiss Financial Market Supervisory Authority FINMA, is available free of charge at Montana Aerospace AG, Alte Aarauerstrasse 11, 5734 Reinach (AG), Switzerland (email: ir@montana-aerospace.com). Investors are furthermore advised to consult their bank or financial adviser before making any investment decision.

This document does not constitute an “offer of securities to the public” within the meaning of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (the “UK Prospectus Regulation”) of the securities in the United Kingdom (the “UK”). Any offers of the securities in the UK will be made pursuant to an exemption under the UK Prospectus Regulation from the requirement to produce a prospectus for offers of the securities. In the UK, this document is only addressed to qualified investors within the meaning of the UK Prospectus Regulation. In addition, this document is only being distributed to and is only directed at (i) persons who are outside of the United Kingdom or (ii) to investment professionals falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FSMA Order”) or (iii) persons falling within articles 49(2)(a) to (d), “high net worth companies, unincorporated associations, etc.” of the FSMA Order, and (iv) persons to whom an invitation or inducement to engage in investment activity within the meaning of section 21 of the Financial Services and Markets Act 2000 may otherwise be lawfully communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

This document does not constitute an “offer of securities to the public” within the meaning of Regulation (EU) 2017/1129 of the European Union, as amended (the „Prospectus Regulation“) in any member state of the European Economic Area (the „EEA“). Any offers of the securities to persons in the EEA will be made pursuant to an exemption under the Prospectus Regulation from the requirement to produce a prospectus for offers of the securities. In any member state of the EEA, this document is only addressed to qualified investors in that relevant member state within

the meaning of the Prospectus Regulation. Statements contained herein may constitute “forward-looking statements”. Forward-looking statements are generally identifiable by the use of the words “may”, “will”, “should”, “plan”, “expect”, “anticipate”, “estimate”, “believe”, “intend”, “project”, “goal”, “aim” or “target” or the negative of these words or other variations on these words or comparable terminology.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other factors that could cause the Company’s or its industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. The Company does not undertake publicly to update or revise any forward-looking statement that may be made herein, whether as a result of new information, future events or otherwise.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, NEW ZEALAND OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD BE UNLAWFUL.

FOR RELEASE IN SWITZERLAND – THIS IS A RESTRICTED COMMUNICATION AND YOU MUST NOT FORWARD IT OR ITS CONTENTS TO ANY PERSON TO WHOM FORWARDING THIS COMMUNICATION IS PROHIBITED BY THE LEGENDS CONTAINED HEREIN.