Montana Aerospace AG (the “Company”) and its operating subsidiaries (the “Group” or “Montana Aerospace”), a leading, highly-vertically integrated manufacturer and supplier of system components and complex assemblies for the aerospace-, e-mobility- and energy industry with worldwide engineering and manufacturing operations, today publishes its H1 2023 results.

HIGHLIGHTS H1 2023

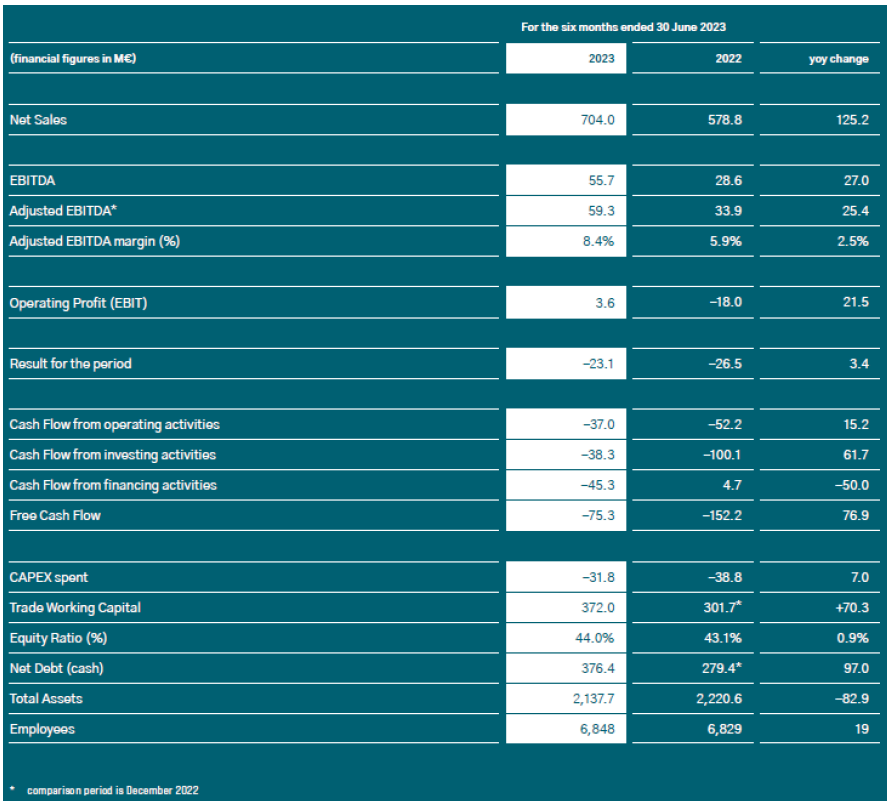

- Financials: Net sales grew by 21.6% yoy to EUR 704.0 million; adjusted EBITDA1 rose by EUR 25.4 million to EUR 59.3 million (+75.0% yoy) through strong developments in the Aerostructures and Energy segments; on a quarterly basis (Q2 vs. Q1 2023) strong EBITDA development with a positive free cash flow

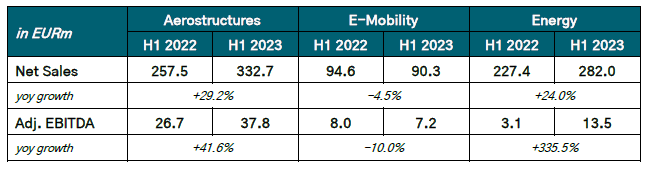

- Segment net sales: Aerostructures: +29%, E-Mobility: -5%, Energy: +24%

- Segment adj. EBITDA: Aerostructures: +42%, E-Mobility: -10%, Energy: +336%

- Guidance reconfirmed: >EUR 1.5 billion net sales and an adj. EBITDA in the range of EUR 130-150 million; clear goal of generating a positive free cash flow and net income; therefore, Montana Aerospace reconfirms its guidance

- Segment guidance reconfirmed: Aerostructures segment set to be the main driver with projections of EUR ~750-800 million net sales, followed by Energy with EUR >550 million and E-Mobility with EUR >200 million of net sales

- Jury in U.S. trial rejects alleged misappropriation: Jury renders verdict in US trial Arconic Corporation against Universal Alloy Corporation, Montana Aerospace AG’s subsidiary, and rejects alleged misappropriation (see Ad Hoc announcement of the company dated 27 July 2023)

CONTINOUS IMPROVEMENTS TROUGHOUT H1 2023

The results of the first six months of 2023 are in line with our guidance in the Aerostructures and E-Mobility segments and exceeding our internal expectations in the Energy segment. Among the highlights of the financial results for H1 2023 are the net sales figures of the Aerostructures segment, which amount to EUR 332.7 million (29% yoy growth), and the adj. EBITDA figures of the Energy segment, which amount to EUR 13.5 million (336% yoy growth).

Net Sales

In the first six months of 2023, Montana Aerospace generated consolidated net sales of EUR 704.0 million, which is 21.6% above the previous year’s first six months EUR 578.8 million. The greatest contribution to net sales was generated by the business segment Aerostructures, which achieved EUR 332.7 million, closely followed by the Energy segment (EUR 282.0 million). In general, this positive development in net sales was supported by Montana Aerospace’s acquisitions of ASCO in the Aerostructures segment and Sao Marco in the Energy business unit in 2022.

EBITDA

Accounting for one-off and non-operative effects — most notably legal costs and post-merger integration (PMI) related expenses — the adjusted EBITDA reached EUR 59.3 million in the first six months of 2023, exceeding the level of EUR 33.9 million in the same period in 2022. This translates into an adjusted EBITDA margin of 8.4% as compared to the previous year’s H1 level of 5.9%. Overall adj. EBITDA performance is still impacted and diluted by the external supply chain issues ASCO is facing within the Aerostructures segment on its path to full integration.

On a non-adjusted level, reported Group EBITDA increased from EUR 28.6 million in the first six months of 2022 to EUR 55.7 million in 2023, which is a 94.8% increase and in line with the increase in the adjusted EBITDA (increase of 75.0% as compared to H1 2022).

This increase in EBITDA can largely be attributed to the substantial improvement in production output (net sales plus change in finished goods; +EUR 103.2 million as compared to H1 2022), which was supported by the gain in market share and higher build rates as well as the strengthening of the workforce to approximately 6,800 employees.

The cost of materials, supplies and services (EUR 441.3 million in the first six months 2023 vs. EUR 393.3 million in the same period in 2022) is under-proportional to net sales development. Personnel expenses continued to rise (EUR 141.2 million for the period ended June 2023 vs. EUR 122.0 million in the same period 2022), although roughly EUR 21 million occurred out of the acquisition of ASCO. Thus, on a like for like basis, it remained almost the same. Montana Aerospace continues to see access to skilled and qualified personnel as well as enough raw materials as crucial milestones to achieve growth in the future.

The three adjustments to EBITDA in the first six months in 2023 were the costs related to PMI expenses related to the acquired ASCO group in 2022, amounting to EUR 0.9 million, followed by legal costs (EUR 1.7 million) as well as the management stock option program (MSOP) of EUR 1.1 million, which overall sum up to EUR 3.7 million.

Net Sales and adj. EBITDA development per segment

Segment sales and EBITDA performance in the first six months in 2023 show Aerostructures and Energy as the key drivers of Montana Aerospace’s business expansion. Aerostructures posted substantial growth of +29.2% with a total revenue of EUR 332.7 million, while Energy showed significant growth of +24.0% with a total revenue of EUR 282.0 million. The E-Mobility segment only shows flattish net sales (EUR 90.3 million in the first six months in 2023 vs. EUR 94.6 million in the same period in 2022) due to the decreased demand of billets (recycling of aluminum) in the external market.

Adj. EBITDA in the E-Mobility segment lies within our guidance, with good potential to overachieve in the quarters to come. The Energy segment achieved an impressive adj. EBITDA of EUR 13.5 million, which is +335.5% compared to H1 2022, establishing itself as a business segment with strong growth and reflecting the market transformation from a pull- towards a push market. Aerostructures also shows improvement of +41.6% compared to the same period last year and posted an adj. EBITDA of EUR 37.8 million, although still dilutive on overall adj. EBITDA due to ongoing supply chain challenges within ASCO, as well as continuous high costs coming along with the ramp up of new long-term contracts.

Trade Working Capital

Concerning trade working capital (TWC), we expect to reach significantly lower and more sustainable TWC levels in all segments as guided previously until the end of 2023. At the end of 2022, we have seen some delayed payments due to optimization reasons. This will change going forward as payments will be made earlier, in line with previous quarters of the respective business years. As net sales rose by ~22%, inventories only rose by roughly 3%, supporting the trend to effective trade working capital management.

Financual result

The financial result was negatively impacted due to substantially higher interest expenses and hiked from EUR -7.5 million to EUR -27.6 million at the end of H1 2023. Nonetheless, within the financial result, more than half of the amount relates to non-cash related items (Foreign exchange (FX) positions). Changes in the financial result are expected within the next months once the ongoing reduction of the debt positions has been achieved.

Ongoing streamlining of our balance sheet

We are fully committed and stick to the plan of further strengthening our balance sheet and increasing independency in 2023 by lowering our debt positions and generating a positive free cash flow. The clear goal of loosening our ties with the majority shareholder Montana Tech Components AG (with respect to debt) and establish a more independent debt financing structure without its guarantees remains intact and is currently being implemented. This step will be a key focus of Montana Aerospace in H2 2023.

Groundbreaking ceremony for Energy’s China plant for E-Mobility

The Energy segment (ASTA group) has opened a new chapter by building a ~1000m2 large facility dedicated to e-mobility, including its own research laboratory, next to its existing plant in Baoying, China. The groundbreaking ceremony took place in July and featured many prominent attendants, including the Deputy Mayor of Yangzhou, the District Governor of Baoying and the Secretary of Baoying Development Zone. Meeting highest requirements of the automotive industry and the e-mobility sector, completion of the plant is scheduled for the end of 2023. With increased capacities for serving its renowned customers, ASTA is expected to further extend its prominent footprint in East Asia.

Conquering the commercial space market

Additionally, Montana Aerospace signed a multi-year contract with a new customer in the fast-growing commercial space market. In the deal, Montana Aerospace’ Aerostructures division subsidiary “Universal Alloy Corporation (UAC) Europe” is supplying highly complex aluminum components from the new production facility in Baia Mare, Romania. The contract marks another business expansion that promises favorable developments in the years to come, leveraging upon the extended production capacities in which Montana Aerospace has invested substantial three-digit million-dollar sums, foremost in Europe.

In addition, Montana Aerospace has achieved further successes on the commercial front. Among manyfold agreements, we signed a multi-year supply contract with Kawasaki Heavy Industries, a Tier-1 supplier to Boeing, and Fuji Industries, a specialized trading company in the aerospace industry, at the Paris Air Show 2023. What is more, Montana Aerospace has successfully started the serial production of a new product line, manufacturing „Section 11 Floor Grids“ for Airbus Atlantic. These are complex components installed in the nose fuselage section of the Airbus A320, one of the most successful commercial airplanes.

Jury in U.S. trial rejects alleged misappropriation

As announced, the jury trial at the District Court in Atlanta rejected damage claims of competitor Arconic Corporation (“Arconic”) against the Company’s subsidiary Universal Alloy Corporation regarding alleged misappropriation of trade secrets. Arconic may file an appeal (see Ad Hoc announcement of the company dated 27 July 2023).

OUTLOOK 2023

Guidance reconfirmed

Facing the positive developments of H1 2023, Montana Aerospace is confident to achieve its 2023 annual targets. We continue to expect total net sales to rise above EUR 1.5 billion in 2023, and our company’s adjusted EBITDA to be in the range of EUR 130 to 150 million. Regarding our business units, the Aerostructures segment is set to be the main driver with projections for net sales of EUR ~750 to 800 million, followed by Energy with net sales of EUR >550 million and E-mobility with net sales of EUR >200 million.

H1 2023 – SELECTED KEY FIGURES

The full H1 2023 is available online at https://www.montana-aerospace.com/en/investors/

UPCOMING EVENTS2

November 2023: Interim Financial Report – Q3 2023

1 Adjusted EBITDA’ as EBITDA (earnings before interest, taxes, depreciation and amortization) adjusted for legal costs (mainly for the Arconic lawsuit), the management stock option program as well as M&A and post merger integration (PMI) related expenses – numbers and reconciliation can be found on page 24 in the H1 interim financial statement 2023.

2 Detailed information can be found here: https://www.montana-aerospace.com/en/investors/

About Montana Aerospace AG

Montana Aerospace AG is a leading manufacturer of system components and complex assemblies for the aerospace industry, with worldwide engineering and manufacturing operations. The Company has approximately 6,800 highly skilled employees at 22 locations on four continents – designing, developing and producing ground-breaking technologies for tomorrow’s aerospace, E-Mobility and energy industries made of aluminium, titanium, composite, copper and steel.

Disclaimer

Statements contained herein may constitute “forward-looking statements”. Forward-looking statements are generally identifiable by the use of the words “may”, “will”, “should”, “plan”, “expect”, “anticipate”, “estimate”, “believe”, “intend”, “project”, “goal”, “aim” or “target” or the negative of these words or other variations of these words or comparable terminology.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other factors that could cause the Company’s or its industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. The Company does not undertake publicly to update or revise any forward-looking statement that may be made herein, whether as a result of new information, future events or otherwise.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO ANY JURISDICTION WHERE TO DO SO WOULD BE UNLAWFUL.

FOR RELEASE IN SWITZERLAND – THIS IS A RESTRICTED COMMUNICATION AND YOU MUST NOT FORWARD IT OR ITS CONTENTS TO ANY PERSON TO WHOM FORWARDING THIS COMMUNICATION IS PROHIBITED BY THE LEGENDS CONTAINED HEREIN.