Montana Aerospace AG (the “Company”) and its operating subsidiaries (the “Group” or “Montana Aerospace”), a leading, highly-vertically integrated manufacturer and supplier of system components and complex assemblies for the aerospace, e-mobility and energy sectors with worldwide engineering and manufacturing operations, publishes its Q3 2021 financial report today after the successful IPO this May, reflecting strengthened confidence in a swiftly recovering market from 2022 onwards. In addition, the Company evaluates the option of a capital increase.

GROWTH STRATEGY ACCELERATED BY FAST & STABLE SECTOR RECOVERY

As a whole group we are very proud to see that our company mission – consisting of pursuing long-term focused goals while being determined to a passionate growth strategy – has put us at the forefront of our peer group in the middle of very exciting market surroundings.

Times remain turbulent and the effects of the pandemic are still reflected in the financial performance and operational capabilities of most companies. However, the crisis has given established players with a solid financial basis like ours the possibility to even improve their positioning. This has led to peaking M&A activities, with even more interesting assets expected to be available on the market in the near future.

Given this market environment, we look forward to the economic cycle ahead of us. As business travel is recovering and vaccination rates in key markets are growing, our outlook is positive and also backed by highly visible contracted sales in aerospace in the amount of EUR 4.3 billion (as per October 2021).

M&A AS PART OF OUR DNA

Besides strong organic growth, Montana Aerospace has focused on a sustainable buildand-buy strategy since Day One. On 07 September 2021, we signed the contract for the takeover of ASCO Industries, the closing of which is still subject to certain conditions. The Asco Group is a leading supplier and development partner of high-end components and structures for the Aerospace industry out of four locations in Belgium, Germany, the United States and Canada with around 1,200 employees. Thereby, Asco generated yearly sales of up to EUR 260 million in the years 2018-2020.

Over the last decade, Montana Aerospace consequently developed from a raw material extrusion supplier to a highly vertically integrated Aerospace player. With the acquisition of Asco Industries, Montana Aerospace will further strengthen its footprint along the value chain with industry wide renown competences in product design, testing and manufacturing of hard metal components and assemblies for wing and fuselage structures.

Since the IPO, Montana Aerospace also acquired the remaining 25% of our South American Energy business, opening up the possibility of signing another acquisition with significant possibilities for the American Energy and E-mobility market and upcycling opportunities in this industry.

OPERATIONALLY ON TRACK IN Q3 2021

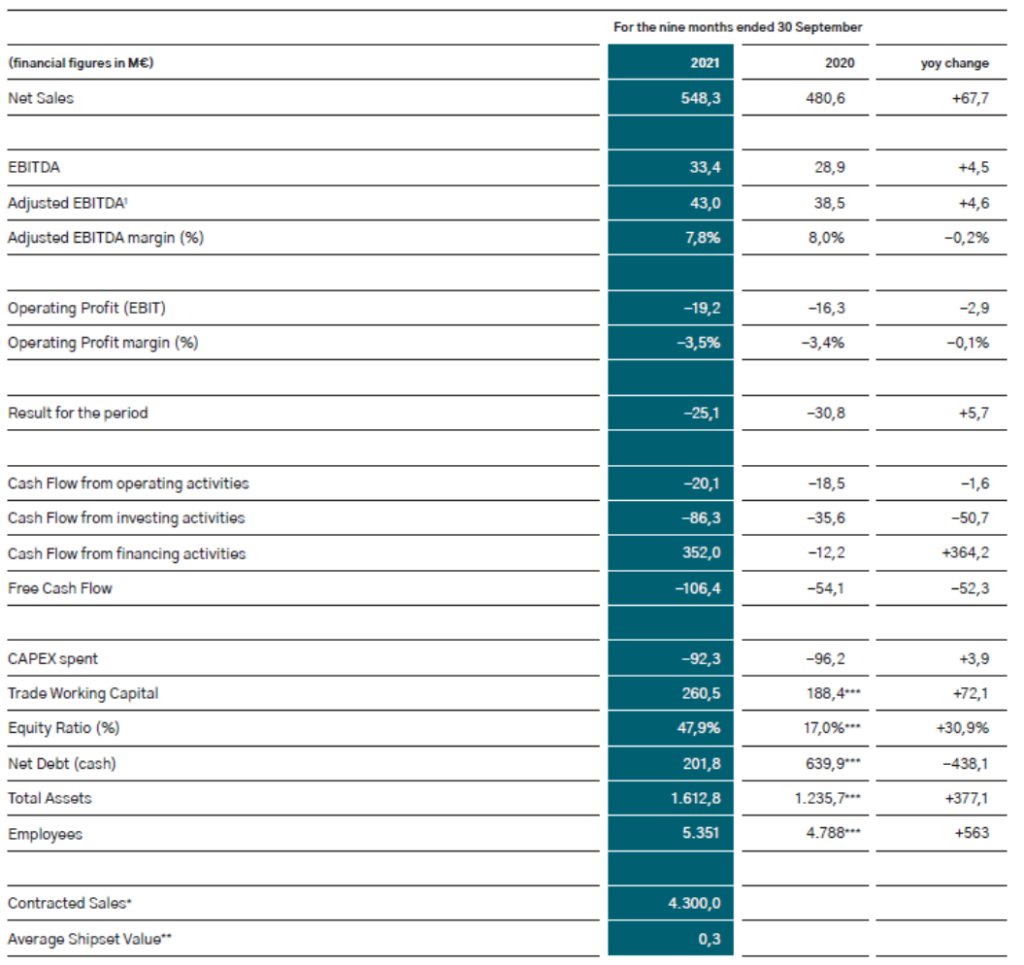

In the first three quarters of 2021, Montana Aerospace generated consolidated Net Sales of EUR 548.3 million, which is 14.1% above the previous year’s EUR 480.6 million and around EUR 200 million above half year’s numbers 2021. The constant pace of improving Sales on a quarterly basis reflects the constant win of market share and the gradual recovery of the markets into direction of pre-Covid levels. Strong Q3 growth in Aerospace reflects positive momentum in the market (+38% vs. Q2 2021/+50% vs. Q3 2020).

Adjusted for one-off and non-operative effects, the adjusted EBITDA reached EUR 43.0 million in the first nine months 2021, well above the level of EUR 38.5 million in the previous year period. The adjusted EBITDA almost doubled in comparison to the first half year 2021 and supports our dedication to over proportionally grow EBITDA to Sales. Results (unadjusted, + EUR 0.6 million) as well as Cash Flow from operating activities (+ EUR 1.7 million) for the third quarter 2021 were – even if only slightly – positive, which confirms recovery of business.

As already elaborated in the first half year results report, Aerospace was more or less unaffected by Covid until May 2020. A comparison of year-on-year Sales therefore still shows around 8% decline. However, Q3 2021 vs. Q3 2020 Sales increased by almost 50%. The largest Sales contribution vs. 2020 has been provided by the Energy sector, generating EUR 270.1 million Net Sales in Q3 2021, an increase by around 32%. E-mobility, as indicated, not only moved from negative to positive margin levels and therefore into

profitability, but also managed an increase in sales by almost 32% to EUR 82.9 million on a YoY comparison.

We confirm our full year guidance which has been stated in the Half-Year Report 2021, with sales of around EUR 750 million.

USE OF WINDOW OF OPPORTUNITY

Around half a year after the IPO, we are seeing that the opportunities on the market regarding additional work-packages and accretive M&A opportunities are more relevant than expected and the consolidation in the aerospace industry is progressing even faster than anticipated. With the signed agreement regarding the acquisition of Asco only a few months following the IPO, Montana Aerospace is taking a very active role in this consolidation and is currently evaluating additional similar acquisitions to grow even further.

Therefore, Montana Aerospace – despite holding a strong cash position out of the IPO and being subject to the requirements of the existing IPO lock up and market conditions – is evaluating the option of a capital increase of up to a maximum of 8 million shares from authorized capital after 15 November 2021 at the earliest with exclusion of pre-emptive subscription rights of shareholders. The aim is to further accelerate organic growth and M&A activities, including, subject to the fulfilment of certain conditions, the current acquisition of the Asco group. Montana Aerospace intends to have a solid cash position to be an active and relevant partner in the accelerating consolidation process and considers the market conditions and environment to be favourable for raising capital on the market. With such a potential capital increase, the liquidity of the stock would also be further strengthened and improved.

In connection with such a potential capital increase, Montana Tech Components AG, the majority shareholder of Montana Aerospace and lender of a hybrid loan to Montana Aerospace in the amount of CHF 169.4 million, is committed to convert such loan amount at arm’s length into Montana Aerospace shares. This would be done by way of a separate capital increase from conditional capital with exclusion of advanced subscription rights of shareholders, at the same time waiving part of the repayment amount at a meaningful discount in favour of Montana Aerospace for early repayment. This step would preserve the liquidity of the Montana Aerospace group, strengthen its equity position and decrease the net debt, thereby further supporting our expansion plans.

“The changes in the market offer incredible chances. Montana Aerospace is dedicated to outperform market growth not only in 2021, but mainly from 2022 onwards. We are very happy to see the results of our efforts in the last quarter: constant growth in sales and over proportional growth in EBITDA“, says Michael Pistauer, CFO of Montana Aerospace.

Q3 2021 – SELECTED KEY FIGURES

Disclaimer

The information contained herein is not for release, directly or indirectly, in or into the United States of America, Canada, Australia, Japan or any other jurisdiction where to do so would be unlawful. This document (and the information contained herein) does not contain or constitute an offer of securities for sale, or solicitation of an offer to purchase securities, in Canada, Australia or Japan or any other jurisdiction where such an offer or solicitation would be unlawful. In particular, this document is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or an exemption from registration. The securities referred to herein have not been and will not be registered under the Securities Act. No public offering of the securities has been or will be made in the United States.

None of the underwriters or any of their respective subsidiary undertakings, affiliates or any of their respective directors, officers, employees, advisers, agents, alliance partners or any other entity or person accepts any responsibility or liability whatsoever for, or makes any representation, warranty or undertaking, express or implied, as to the truth, accuracy, completeness or fairness of the information or opinions in this announcement (or whether any information has been omitted from the announcement) or any other information relating to the Group, its subsidiaries or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this announcement or its contents or otherwise arising in connection therewith. Accordingly, each of the underwriters and the other foregoing persons disclaim, to the fullest extent permitted by applicable law, all and any liability, whether arising in tort or contract or that they might otherwise be found to have in respect of this announcement and/or any such statement.

This communication is not an offer to sell or a solicitation of offers to purchase or subscribe for securities. This communication is not a prospectus within the meaning of the Swiss Financial Services Act (the “FinSA”) and will not be reviewed by any competent authority. Any offer of securities of the Company will be made solely by means of, and on the basis of, a prospectus that will contain, among others, detailed information about the Company and its management, the offered securities (specifically the associated rights, obligations and risks) as well as the offer itself. This communication constitutes no advertising in the sense of article 68 of the FinSA. Such advertisements are communications to investors aiming to draw their attention to financial instruments. Any investment decisions with respect to any securities should not be made based on this advertisement. Any person considering the purchase of any securities of the Company must inform itself independently based solely on such prospectus (including any supplement thereto). The prospectus, which has been approved by a reviewing body recognised by the Swiss Financial Market Supervisory Authority FINMA, is available free of charge at Montana Aerospace AG, Alte Aarauerstrasse 11, 5734 Reinach (AG), Switzerland (email: ir@montana-aerospace.com). Investors are furthermore advised to consult their bank or financial adviser before making any investment decision.

This document does not constitute an “offer of securities to the public” within the meaning of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (the “UK Prospectus Regulation”) of the securities in the United Kingdom (the “UK”). Any offers of the securities in the UK will be made pursuant to an exemption under the UK Prospectus Regulation from the requirement to produce a prospectus for offers of the securities. In the UK, this document is only addressed to qualified investors within the meaning of the UK Prospectus Regulation. In addition, this document is only being distributed to and is only directed at (i) persons who are outside of the United Kingdom or (ii) to investment professionals falling within article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FSMA Order”) or (iii) persons falling within articles 49(2)(a) to (d), “high net worth companies, unincorporated associations, etc.” of the FSMA Order, and (iv) persons to whom an invitation or inducement to engage in investment activity within the meaning of section 21 of the Financial Services and Markets Act 2000 may otherwise be lawfully communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

This document does not constitute an “offer of securities to the public” within the meaning of Regulation (EU) 2017/1129 of the European Union, as amended (the „Prospectus Regulation“) in any member state of the European Economic Area (the „EEA“). Any offers of the securities to persons in the EEA will be made pursuant to an exemption under the Prospectus Regulation from the requirement to produce a prospectus for offers of the securities. In any member state of the EEA, this document is only addressed to qualified investors in that relevant member state within

the meaning of the Prospectus Regulation.

Statements contained herein may constitute “forward-looking statements”. Forward-looking statements are generally identifiable by the use of the words “may”, “will”, “should”, “plan”, “expect”, “anticipate”, “estimate”, “believe”, “intend”, “project”, “goal”, “aim” or “target” or the negative of these words or other variations on these words or comparable terminology.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other factors that could cause the Company’s or its industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. The Company does not undertake publicly to update or revise any forward-looking statement that may be made herein, whether as a result of new information, future events or otherwise.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, NEW ZEALAND OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD BE UNLAWFUL.

FOR RELEASE IN SWITZERLAND – THIS IS A RESTRICTED COMMUNICATION AND YOU MUST NOT FORWARD IT OR ITS CONTENTS TO ANY PERSON TO WHOM FORWARDING THIS COMMUNICATION IS PROHIBITED BY THE LEGENDS CONTAINED HEREIN.